Direct Selling News Founder Stuart Johnson Shares: Powering the Channel’s Success

In his recent article and in-depth analysis published on Direct Selling News (10/28/2025), Stuart Johnson shares his personal perspectives on service-based companies within the direct selling channel, and why he feels it’s “one sector that has quietly—and steadily—surged ahead.” [article reprinted with permission]

POWERING THE CHANNEL’S SUCCESS

Services are surging—and redefining how direct selling’s next great chapter will be written.

Over the past decade, direct selling has weathered extraordinary change. Consumers now live in a digital-first world where convenience, comparison and immediacy define purchasing decisions. Party plans, home demonstrations and in-person events—once the heart of the channel—have given way to virtual sales, social commerce and subscription models that operate around the clock.

Yet even as product-based companies have fought to adapt, one sector has quietly—and steadily—surged ahead. Services have become the most consistent source of growth and stability in direct selling, outpacing nearly every other category and now representing more than $30 billion in annual US revenue.

This isn’t happening in a vacuum. More than 70 percent of the US economy is services based, and the direct selling channel now mirrors that transformation—60 percent of the channel’s total volume now comes from services rather than products.

That alignment is no accident. It reflects where the greatest consumer demand—and the most resilient opportunity—now exist. Real estate, financial planning, insurance, legal protection, travel, energy and digital platforms all meet daily, recurring needs. These are not impulse purchases or seasonal trends; they are the enduring essentials of modern life.

While traditional product categories have faced challenges for over a decade, the service sector has accelerated. Nearly 70 percent of service-based companies have grown during that same period, even as their product-driven peers have face challenges.

The reason is simple: people don’t need to be convinced to buy a home, an insurance policy, electricity or broadband—they already understand their value.

Within this expanding $30 billion sector, four categories now define the new era of services in direct selling:

- Licensed real estate agents

- Licensed financial services agents

- Traditional direct selling/network marketing for services

- Direct selling/network marketing hybrid applications

Each category represents both a new frontier and a reflection of direct selling’s deepest strength—helping individuals build businesses rooted in trust, access and community.

Licensed real estate agents

Few industries better illustrate the convergence of entrepreneurship, innovation and scale than real estate. It is—by every definition—direct selling, though many still don’t recognize it as such.

Agents are independent contractors. They build their own businesses, generate their own leads and earn commissions on personal production as well as on the performance of the agents they recruit, mentor and support. In both structure and spirit, that model mirrors the DNA of this channel.

For years, real estate operated in a separate orbit—viewed as a professional service rather than part of direct selling. That perception is changing fast. As data-driven models, revenue-sharing compensation and virtual brokerages have redefined the agent experience, real estate now stands as one of the clearest examples of direct selling at scale.

Keller Williams began that transformation in 1983, pioneering the industry’s first profit-sharing system. Rather than reserving profits for owners, Gary Keller built a culture of shared success that rewarded agents for helping grow their offices. The model aligned incentives, encouraged collaboration and created a blueprint for many service-based compensation systems. As of summer 2024, Keller Williams had paid out over $2 billion in lifetime profit sharing—an extraordinary example of what happens when shared value drives shared effort.

Building on that foundation, Glenn Sanford, Founder and CEO of eXp World Holdings (NASDAQ: EXPI), took the next bold step—launching the first fully cloud-based brokerage and introducing revenue share instead of profit share. The company went public in 2013 and began granting equity ownership in 2014, two moves that accelerated its exponential growth.

Today, eXp counts roughly 82,000 agents worldwide and is forecast to generate just under $5 billion in 2025 revenue. It proved that a digital-first company could scale faster and more profitably than traditional brokerages—all while giving agents something far more valuable than commissions: ownership.

Today, eXp counts roughly 82,000 agents worldwide and is forecast to generate just under $5 billion in 2025 revenue. It proved that a digital-first company could scale faster and more profitably than traditional brokerages—all while giving agents something far more valuable than commissions: ownership.

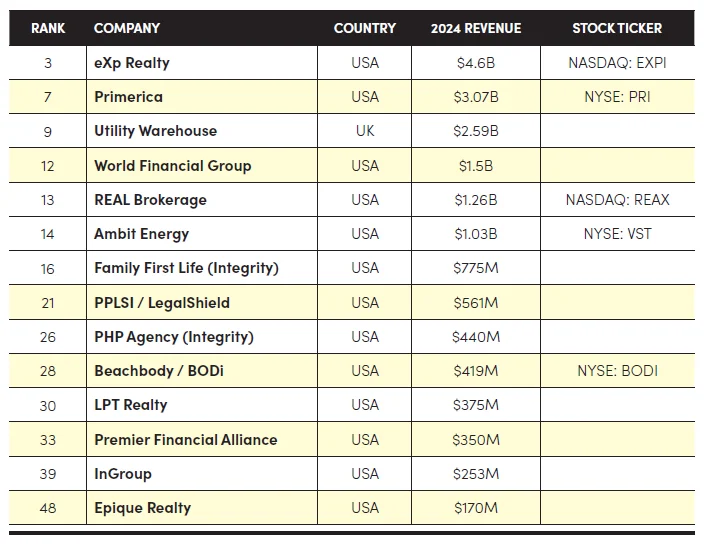

That success has sparked innovation across the category. REAL Brokerage (NASDAQ: REAX), LPT Realty and Epique Realty have introduced hybrid models combining flexible compensation, cloud-based systems and stock participation. All three companies made the most recent DSN Global 100 List, reserved for direct selling companies doing a minimum of $100 million in annual revenue.

Realty of America and ENRG Realty are among the newest entrants to the real estate category, leveraging technology and a flexible, scalable system to meet agents where they are while preserving entrepreneurial independence.

This model has set a new standard in the real estate industry. In fact, approximately 10 percent of active agents in the US are now participants in a cloud-based, revenue-sharing model.

Collectively, real estate companies now represent more than half of the entire services economy in direct selling—over $15 billion in annual revenue.

If we define direct selling by its structure—independent contractors building personal businesses through referral and recruitment—then real estate has been part of this channel all along. What’s different now is recognition. Analysts, investors and even participants are beginning to acknowledge what has always been true: real estate isn’t adjacent to direct selling—it is direct selling, on a massive scale.

At Your Service: Real estate has become the case study for how innovation can elevate both income and influence. By merging digital infrastructure with shared ownership, these companies have transformed salespeople into shareholders and transactions into communities—proof that when people participate in what they help build, the entire system grows stronger.

Licensed Financial Services Agents

If real estate represents the visible evolution of direct selling, financial services represent its moral and economic foundation. This is where the channel’s deepest purpose lives: helping people secure their financial future.

If real estate represents the visible evolution of direct selling, financial services represent its moral and economic foundation. This is where the channel’s deepest purpose lives: helping people secure their financial future.

The modern story begins with Art Williams, who founded A.L. Williams & Associates—today Primerica (NYSE: PRI)—in 1977. His simple mission, “buy term and invest the difference,” reshaped the insurance and investment landscape. Williams democratized financial education, showing that ordinary families could make extraordinary progress with simple, actionable tools. Just as important, he created a new career path: a licensed, commissionable business built on leadership, mentorship and multiplication. Finally, Williams and Primerica were the pioneers of facilitating equity participation in this segment.

Companies like World Financial Group, Premier Financial Alliance and numerous others have adapted the model for new markets and generations. But the most powerful consolidation story belongs to Integrity Marketing Group.

Founded in 2006 and headquartered in Dallas, Integrity has executed more than 200 acquisitions, creating one of the largest privately held financial services companies in America. Amongst those acquisitions were a handful of major direct selling players they refer to as Inspiration Marketing—Family First Life, People Helping People (PHP) Agency, North American Senior Benefits (NASB), Equis Financial, The Alliance and Hegemon Group.

Integrity extends equity participation to agency owners it acquires, aligning incentives and fueling long-term loyalty. It’s clear an IPO is also on the horizon for them. Integrity’s approach echoes the ownership ethos of real estate’s revenue-sharing pioneers and proves that shared value translates across service categories.

Founded in 2019, FinFit Life bridges the worlds of licensed financial services and wellness by positioning “financial fitness” alongside physical and mental well-being. The company emphasizes that true security isn’t just about accumulation—it’s about alignment. Through licensed professionals who offer life insurance, wealth-building strategies and holistic health education, FinFit Life empowers individuals to secure their financial future while also investing in lifetimes of vitality and purpose.

While still emerging, it shows how the next generation of financial services companies can combine protection, personal development and engagement in one platform—an approach that complements the major players while charting its own course.

Financial services companies succeed not because they sell complex products, but because they simplify access to essential ones—life insurance, annuities and investment basics. The category continues to professionalize the channel, attracting licensed, credentialed entrepreneurs whose success is measured in both commissions and client outcomes.

As a group, licensed financial services accounts for approximately $12 billion in annual revenue in the US.

At Your Service: Financial services companies are redefining what credibility looks like in direct selling. They’ve proven that mission and margin can coexist—and that empowering people to protect and plan for their futures is the ultimate recurring service. In many ways, this category represents the channel’s conscience, reminding us that education and entrepreneurship—when combined—can create generational change.

Traditional Direct Selling/Network Marketing for Services

In many ways, traditional direct selling/network marketing for services carries forward the original spirit of the channel: one person helping another access something better. While this segment, which doesn’t require licensing, represents approximately 10 percent of the total services market, it continues to outperform in retention, predictability and consumer loyalty.

ACN, launched in 1993, was among the first to capitalize on telecommunications deregulation, building a global business that offered phone, internet, mobile and later energy services through a direct selling model. Its founders proved that essential household services could be sold person-to-person, combining trust and convenience in ways large utilities could not.

More than a decade later, Ambit Energy (NYSE: VIS), founded in 2006, extended that same principle into the deregulated energy market—demonstrating that electricity and natural gas could also thrive in a referral-driven model. Ambit’s growth was explosive, and it went on to become (and still remains) a billion-dollar enterprise built on recurring customers and representative loyalty.

Together, ACN and Ambit laid the foundation for what would become the energy services era in direct selling.

Now, newer entrants such as Think Energy, relaunched under new ownership in 2023, are modernizing the concept for a new generation. With a focus on renewable energy, digital onboarding and sustainability-driven messaging, Think Energy represents the next evolution of the model those pioneers built—proof that even in a changing energy landscape, essential services never go out of style.

Outside the US, Utility Warehouse (LSE: TEP) in the United Kingdom has achieved extraordinary results by consolidating essential household services—energy, broadband, mobile and insurance—into a single, simplified monthly bill. Utility Warehouse surpassed 1.4 million customers and delivered millions of bundled services in 2024. They generated $2.6 billion in annual sales during the fiscal year while operating in just one country. Its growth is a testament to the power of focus, simplicity and the strength of recurring, essential services.

Meanwhile, PPLSI (Pre-Paid Legal/LegalShield) remains the model’s most enduring success story. More than five decades since its founding, it still generates over $500 million annually by transforming an intimidating necessity—legal access and identity theft protection services—into affordable subscription products that millions rely on.

inGroup (formerly inCruises) has brought that same model to travel, converting memberships into experiences and loyalty into lifestyle. Its sustained growth in a volatile global travel market underscores how services rooted in value and community can transcend economic cycles. As the company approaches its tenth anniversary next year, they will generate more than $300 million in sales this year, proof of the durability of its membership approach and global reach.

Collectively, this category represents approximately $3 billion in annual revenue in the US.

At Your Service: Network marketing for services continues to do what it has always done best: simplify complexity through human connection. These companies thrive not by selling what’s new, but by delivering what’s needed, over and over again. Their quiet success is a reminder that the truest measure of innovation isn’t invention—it’s consistency.

Direct Selling/Network Marketing Hybrid Applications

Beyond the three established categories of real estate, financial services and traditional network marketing, a new frontier has emerged at the intersection of digital culture and recurring value. These hybrid and membership-based models merge the reach of social media with the predictability of subscription commerce, creating modern ecosystems of engagement that blur the line between product and service.

This space remains experimental. Only a few companies have managed to turn early momentum into lasting growth, but their efforts are shaping how future consumers might experience direct selling.

BODi, formerly Beachbody (NYSE: BODI), offered one of the earliest glimpses of this evolution. Digital memberships represent slightly more than half of total revenue—a remarkable milestone that positions the company as a leader in hybrid innovation. However, subsequent private equity transitions and shifting market conditions have exposed the fragility of these models when balance and brand clarity are lost. In fact, since pivoting to an affiliate model in Q4 of 2024, BODi has seen its revenue decline by 50 percent.

Founded by Amanda Tress in 2016, FASTer Way to Fat Loss has become one of the most successful examples of how digital communities can transform wellness into a recurring service. They’ve utilized a two-level enhanced affiliate model from Day One. The program blends personalized coaching, live accountability and technology-driven nutrition and fitness tools to create a scalable experience that feels both personal and communal.

What began as an online fitness program has evolved into a subscription-based ecosystem built on measurable progress and peer motivation. Participants subscribe for access to exclusive content, structured coaching cycles and real-time feedback—all designed to deliver ongoing value beyond a single purchase or challenge. FASTer Way has also expanded into consumables such as protein, hydration and collagen, a fast-growing segment that now contributes an increasing share of its revenue.

In 2023, FASTer Way earned DSN’s first Bravo Innovator Award, recognizing its pioneering use of digital tools to elevate the customer journey. Its model has since become a benchmark for the emerging hybrid and membership space—proof that when technology, community and consistency intersect, engagement can become its own form of service.

LiveGood is helping refine the concept by offering low-cost membership access to discounted wellness products—an approach that bridges affordability with affiliation. Its model emphasizes access over exclusivity, combining the simplicity of ecommerce with the loyalty dynamics of subscription services. The company’s rapid adoption (over two million cumulative members have joined in under three years) underscores a broader truth: simplicity and accessibility still sell.

Since its launch in 2016, 7k Metals has occupied a unique space in direct selling. While technically a product company selling gold, silver and collectible coins, its model functions as a membership-based service. Members pay a recurring fee for access to wholesale pricing, wealth education and digital tools that simplify the process of owning tangible assets. The result is a fintech-style experience that blends asset accumulation with community engagement. 7k’s approach demonstrates how service-minded innovation can blur the line between tangible products and recurring value—a theme increasingly shaping the channel’s evolution.

While still a small portion of the overall services economy, these hybrid models represent approximately $1 billion in annual revenue and growing—this is truly the channel’s laboratory for digital evolution. They are proving grounds for innovation, where community, coaching and content converge into scalable, service-like ecosystems that may well define the next era of engagement.

At Your Service: Hybrid and membership models are testing how digital connection and recurring value can coexist. While this model has yet to reach its full potential and continues to evolve, it is charting a path for how the channel might thrive in a world where membership replaces inventory and engagement replaces transactions.

The Road Ahead

The rise of services within direct selling is not a temporary trend—it’s a structural realignment with the broader economy. As the US economy operates at roughly 70 percent services, the direct selling channel—now at approximately 60 percent—has followed suit. This symmetry underscores not only where the opportunity lies, but where relevance will be maintained.

Services thrive because they are essential, renewable and relational. They generate predictable revenue, foster professional credibility and sustain engagement long after the first sale. Whether through licensed professionals, network marketing or digital communities, service-based models are now the backbone of the channel’s next chapter.

As services continue to power growth, they reaffirm that this channel’s greatest strength has always been its adaptability. Direct selling has never been about what we sell—it’s about how we serve. And in that service, the industry’s future is not just secure—it’s expanding.

The Equity Revolution—from Profit Sharing to Ownership

For decades, the cornerstone of direct selling—and of the American entrepreneurial spirit—has been the idea of shared success. In the services sector, that concept has evolved into one of the most powerful forces in the channel today: equity sharing.

The roots of this shift trace back to Gary Keller, who pioneered a profit-sharing model at Keller Williams in 1983. By distributing a portion of office profits to agents who helped grow their local market centers, Keller reframed the brokerage model as a collaborative ecosystem rather than a competitive hierarchy. The approach worked: by 2024, Keller Williams had paid out more than $2 billion in lifetime profit sharing, turning the idea of shared reward into an enduring differentiator. In

The roots of this shift trace back to Gary Keller, who pioneered a profit-sharing model at Keller Williams in 1983. By distributing a portion of office profits to agents who helped grow their local market centers, Keller reframed the brokerage model as a collaborative ecosystem rather than a competitive hierarchy. The approach worked: by 2024, Keller Williams had paid out more than $2 billion in lifetime profit sharing, turning the idea of shared reward into an enduring differentiator. In

January 2025, the private equity firm Stone Point Capital purchased a majority interest in Keller Williams. It’s also interesting to note that Stone Point acquired majority interest in PPLSI/Legal Shield, another legacy direct selling services company in 2018. Listening to the market, we can only assume that an IPO (and equity sharing) is in Keller Williams’s future.

Glenn Sanford, Founder and CEO of eXp Realty (NASDAQ: EXPI) transformed profit sharing into a wealth creation engine. Sanford not only shifted from profit sharing to revenue sharing—rewarding agents with a percentage of gross revenue rather than net profit—but also moved the entire brokerage into a cloud-based model. This eliminated the overhead of physical offices and allowed him to redirect that value to agents. In 2013, he took the company public and in 2014 began granting equity ownership to the field—what he calls the most important decision of his career.

Those innovations reshaped the competitive landscape. Equity sharing transformed agents into stakeholders, aligning their incentives with the company’s long-term performance. It’s no coincidence that eXp World Holdings grew from fewer than 1,000 agents in 2014 to more than 82,000 agents worldwide and just under $5 billion in projected annual revenue for 2025.

The company became a model that others—REAL Brokerage (NASDAQ: REAL), LPT Realty, Epique Realty, Realty of America and ENRG Realty—emulated, each offering some combination of revenue share, profit share and equity stakes. It’s a model that clearly resonates. REAL is approaching $2 billion in annual revenue, and LPT is approaching $1 billion. Additionally, LPT is planning an IPO in 2026, and Epique, Realty of America and ENRG have all expressed aspirations of going public in the future in order to share equity with the saleforce. Whether through private stock, pre-IPO opportunities or discounted purchase programs, equity participation has become table stakes for attracting and retaining top talent.

The trend is also spreading beyond real estate. In financial services, companies like Primerica (NYSE: PRI) have used public market participation and discounted stock programs to give agents a sense of ownership in the enterprise. Integrity Marketing Group—one of the sector’s largest aggregators—extends private stock to agency owners it acquires, creating alignment and anticipation for its eventual public offering. While the equity conversation in insurance isn’t as clear as in real estate, it’s gaining traction across the broader services landscape.

The reason is simple: ownership builds commitment. When representatives can literally invest in the success of the company, their relationship deepens from participant to partner. Equity turns engagement from transactional to transformational.

As new entrants like REAL, LPT, Epique, Realty of America and ENRG continue to innovate around shared ownership and performance-based equity rewards, the model is moving closer to the core of what makes services such a powerful fit for direct selling—recurring value, recurring revenue and recurring wealth.

Equity may not replace cash compensation, but it is redefining what success looks like.

Disclaimer: At BFH, we strive to keep all content—articles, press releases, data—as accurate and current as possible at time of publishing. However, treat this content as a guide, not as definitive authority for business decisions. Publishing a press release does not imply Business For Home BV endorses a company or individual, nor guarantees its claims. No warranties or representations, expressed or implied, are made regarding the accuracy, completeness, or suitability of information provided on this website. All content is provided “as-is,” without liability for errors or usage. Always fact-check and conduct your own due diligence. BFH publishes press releases for the global Direct Selling / Network Marketing / Home Business community. Laws governing Direct Selling can vary greatly by country; BFH does not warrant that any company or content is in full compliance with various local or country-specific laws; it’s up to the reader to research, verify and comply with all applicable local regulations.