LifeVantage Q4 Revenue Up 5.7% To $59.4 Million

LifeVantage Corporation (Nasdaq: LFVN) today reported financial results for its fourth quarter and full fiscal year ended June 30, 2020.

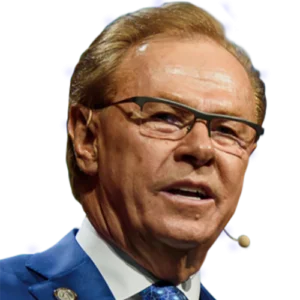

“We are pleased to finish fiscal 2020 with a strong quarter while navigating the challenges of the current global pandemic,”

stated LifeVantage President and Chief Executive Officer, Darren Jensen.

“During the quarter, we saw continued momentum in revenue, operating margin and EBITDA, as well as sequential growth in the number of total active accounts. We finished the year with 31% adjusted EBITDA growth and in a very strong financial position with $22 million in cash and zero debt.

I am so proud of our team across the board who has excelled during these unprecedented times and want to thank each and every one of our employees and distributors for making 2020 a record year.”

Fourth Quarter Fiscal 2020 Highlights*:

- Revenue of $59.4 million was up 5.7% from the prior year period;

- Revenue in the Americas increased 5.9% and revenue in Asia/Pacific & Europe increased 5.1%;

- Average revenue per account increased 12.8%;

- Total active accounts increased 2.3% sequentially to 179,000, while declining year over year by 3.2%. The sequential growth included a 10.6% increase in distributors and a 2.8% decline in customers. On a year over year basis, distributors increased 10.6% and customers declined 10.9%;

- Earnings per diluted share were $0.26, consistent with the prior year period;

- Adjusted earnings per diluted share were $0.28, compared to $0.26 in the prior year period; and

- Adjusted EBITDA increased 6.7% to $8.2 million year over year.

* All comparisons are on a year over year basis and compare the fourth quarter of fiscal 2020 to the fourth quarter of fiscal 2019, unless otherwise noted.

Fiscal Year 2020 Highlights**:

- Revenue increased 3.1% to $232.9 million;

- Revenue in the Americas increased 1.9% and revenue in Asia/Pacific & Europe increased 6.1%;

- Earnings per diluted share were $0.79, compared to $0.50 in fiscal 2019;

- Adjusted earnings per diluted share were $0.86, compared to $0.59 in fiscal 2019;

- Adjusted EBITDA increased 31.3% to $24.0 million;

- Repurchased 387,000, or $5.4 million, of common shares, and paid down $1.5 million of long-term debt, reflecting strong cash flow from operations of $18.3 million; and

- Strong balance sheet with $22.1 million of cash and no debt.

**All growth rates compare fiscal 2020 to fiscal 2019.

Get more information, facts and figures about LifeVantage, click here for the LifeVantage overview.

Recommended Distributors LifeVantage

Sheryl North

Patti Palka

Kristin Bailey

Jessica Perez

Shawn Brandt

Harvey Conner

Bridget Baker

Renee Parker

Laura Nowicki

Helga Dalla